All-in-one compliance solution

Offload your regulatory burden and focus on your core business

The lack of robust Know Your Customer (KYC) and Anti Money Laundering (AML) processes exposes companies to fines and reputational damage.

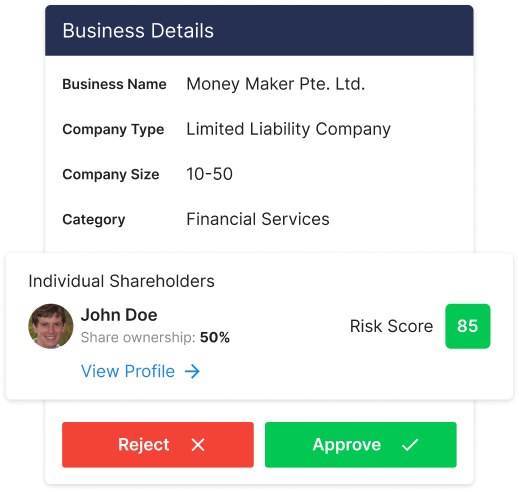

OneHypernet's Customer Due Diligence (CDD) solution helps companies comply with regulatory requirements while automating the entire process to save you time and cost.

Ideal for these industries

Real Estate

Law Firms

Accounting Services

Pawnbrokers

Precious Stones

Luxury Goods

World's largest PEP database

Trusted by banks, government agencies, and law firms around the world

Over 3 million

entities and profiles

Over 250

countries and territories

24 hours

daily database update

Over 1,300

law agencies enforcement

Comprehensive global sanctions and watchlists data

Screen against various global databases for

Politically exposed person (PEP)

Politically exposed person (PEP) Adverse media and news

Adverse media and news Major watchlists such as UN, OFAC, EU

Major watchlists such as UN, OFAC, EU Government watchlists such as MAS in Singapore

Government watchlists such as MAS in Singapore

Ongoing monitoring with record keeping and audit trail

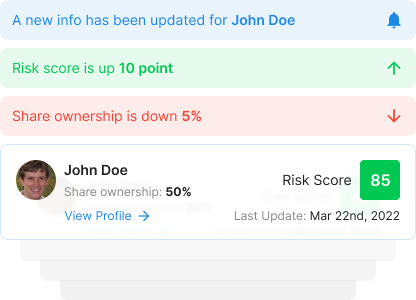

Automate your monitoring and get notified if the risk profile of your customers change

Automate your monitoring and get notified if the risk profile of your customers change Every action is timestamped into an audit trail for future verification to comply with regulators and auditors

Every action is timestamped into an audit trail for future verification to comply with regulators and auditors