Cross-border payments are inefficient because there is no ubiquitous global system; users operate on different platforms known as correspondent banking.

Regardless of what happens at the front, almost all cross-border payments are ultimately settled on legacy banking infrastructure at the back.

This means that whether it’s a traditional bank remittance or a FinTech wallet transfer, settlement happens in the same manner in the background.

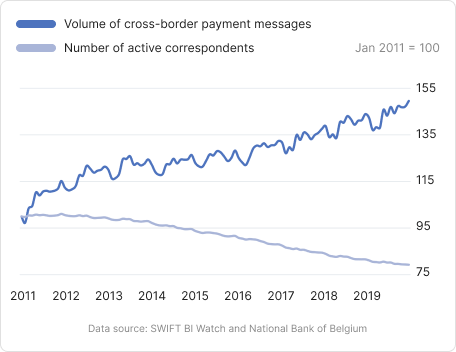

This problem is exacerbated by the declining trend of correspondent banking relationships globally even as cross-border activity increases, leading to higher costs of cross-border payments.

This needs to change. But how?

To achieve the same level of efficiency as local payments, cross-border markets need to be connected on a unified ecosystem yet allow each user to retain autonomy over their data, internal processes, and adherence to local regulatory requirements. This is only possible with a decentralised solution since international markets are decentralised by nature.

The OneHypernet team brings decades of experience from founding several of the largest money service businesses in Asia since 1990, including Thin Margin, the first and largest online money-changer in Singapore, and a winner of the 2018 MAS FinTech Awards.

OneHypernet has also been awarded the Monetary Authority of Singapore’s Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant for our decentralised multilateral netting solution.